Why Insurance Underwriters Are Demanding Threat Assessments Now

- CrisisWire

- Sep 28, 2025

- 2 min read

The insurance industry is no longer content with simply writing policies and paying out claims. Today, underwriters are increasingly demanding proof of proactive risk management—and threat assessments are at the center of this shift.

Whether you’re a school, hospital, business, or government agency, the question is no longer if you’ll need one, but when.

Why Threat Assessments Matter to Insurers

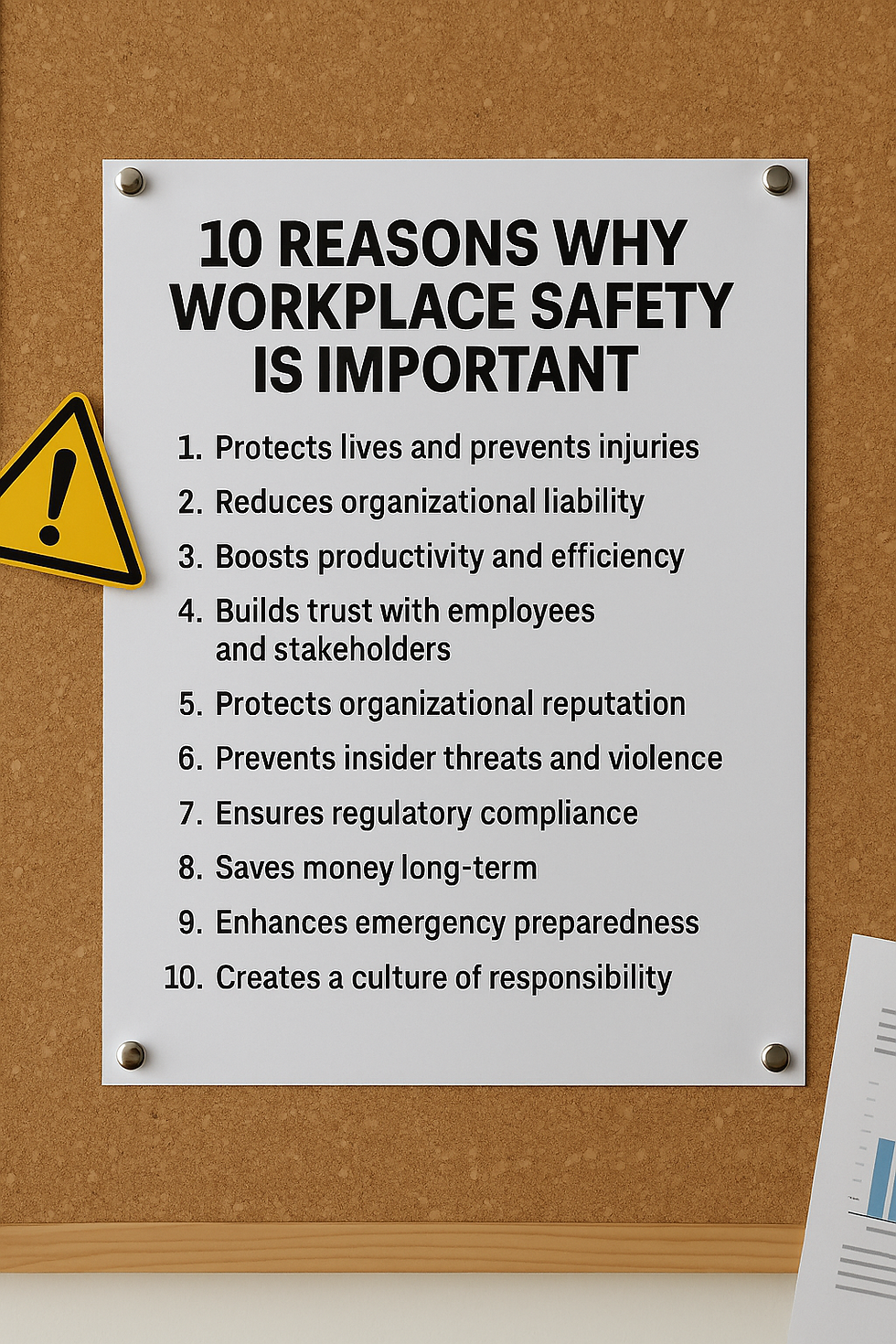

Insurance companies are in the business of measuring and managing risk. As mass shootings, workplace violence, insider threats, and cyber-physical attacks rise, underwriters are recalibrating their formulas. They want to see:

Formalized threat assessment processes in place.

Emergency preparedness plans tested and documented.

Access control and visitor management policies applied consistently.

Evidence of training and drills for staff and leadership.

Without these, your premiums go up—or worse, coverage may be denied.

Real-World Trends

Schools and universities are being asked to provide proof of Behavioral Threat Assessment Teams (TATs).

Hospitals must demonstrate workplace violence prevention plans to satisfy OSHA and Joint Commission standards.

Corporations face exclusions for insider threat incidents if they cannot show pre-incident risk mitigation policies.

Legal and Financial Pressure

Failing to conduct threat assessments is no longer just a safety oversight—it’s a liability exposure. Insurance underwriters know plaintiffs’ attorneys will argue negligence if organizations can’t demonstrate they took reasonable steps to prevent foreseeable harm.

Rising jury verdicts in workplace violence cases have exceeded millions.

Board members and executives can be held personally liable for failures in duty of care.

Steps Organizations Must Take Now

Conduct a Comprehensive Threat Assessment — Identify vulnerabilities across people, facilities, and policies.

Document Findings — Create a defensible paper trail showing proactive leadership.

Implement Corrective Actions — From physical access upgrades to insider threat training.

Align with Standards — FEMA, DHS, OSHA, and industry-specific compliance frameworks.

Update Annually — Treat assessments as living documents, not one-time reports.

Why CrisisWire is Your Partner in Readiness

At CrisisWire Threat Management Solutions, we specialize in creating the frameworks, audits, and policy documentation underwriters demand. Whether it’s a Behavioral Threat Assessment (BTA) model for schools, a workplace violence prevention plan for businesses, or a continuity-of-operations audit for government, we provide compliance-grade assessments that reduce liability and protect lives.

👉 Contact us today at crisiswire@proton.me to schedule your organization’s threat assessment.

Related Resources

Each book provides practical frameworks that align with what underwriters expect to see in today’s environment.

Conclusion

Insurance companies are sending a clear message: safety and liability are inseparable. Organizations that fail to perform threat assessments will pay the price—in higher premiums, denied claims, and reputational damage. Those that act now will not only protect their people but also gain leverage with insurers.

The time to act isn’t after a tragedy. The time is now.

Comments